Investing and Building Value with

Experience · Accountability · Integrity

Experience · Accountability · Integrity

We are a private equity firm with a unique combination of C-level industrial executives with deep operational experience from General Electric for over 25 years, combined with a team of private equity professionals with world-class credentials.

Our private equity focus is driven by our operational excellence. We invest in and build strong businesses to create sustainable value.

We do more than add capital – we help companies improve operations and/or transform digitally.

The Falco team knows how to strategize, execute and build long-term value for its assets, globally.

We launched the Protection Fund, a thematic mid-market buyout fund, and are in the process of raising funds with a target size of $1.2 billion.

Or listen to us talk about the Protection Fund

Request More Information

Our Investment Strategy

Our fund targets buyouts of companies for a controlling stake:

What Is Protection

Our definition of protection, enabling secure and sustainable living:

How We Create Value

FGP is buying right and building right, offering a distinctive value creation proposition:

Or listen to us talk about the Falco Global Quality Asset Opportunity Fund

Request More Information

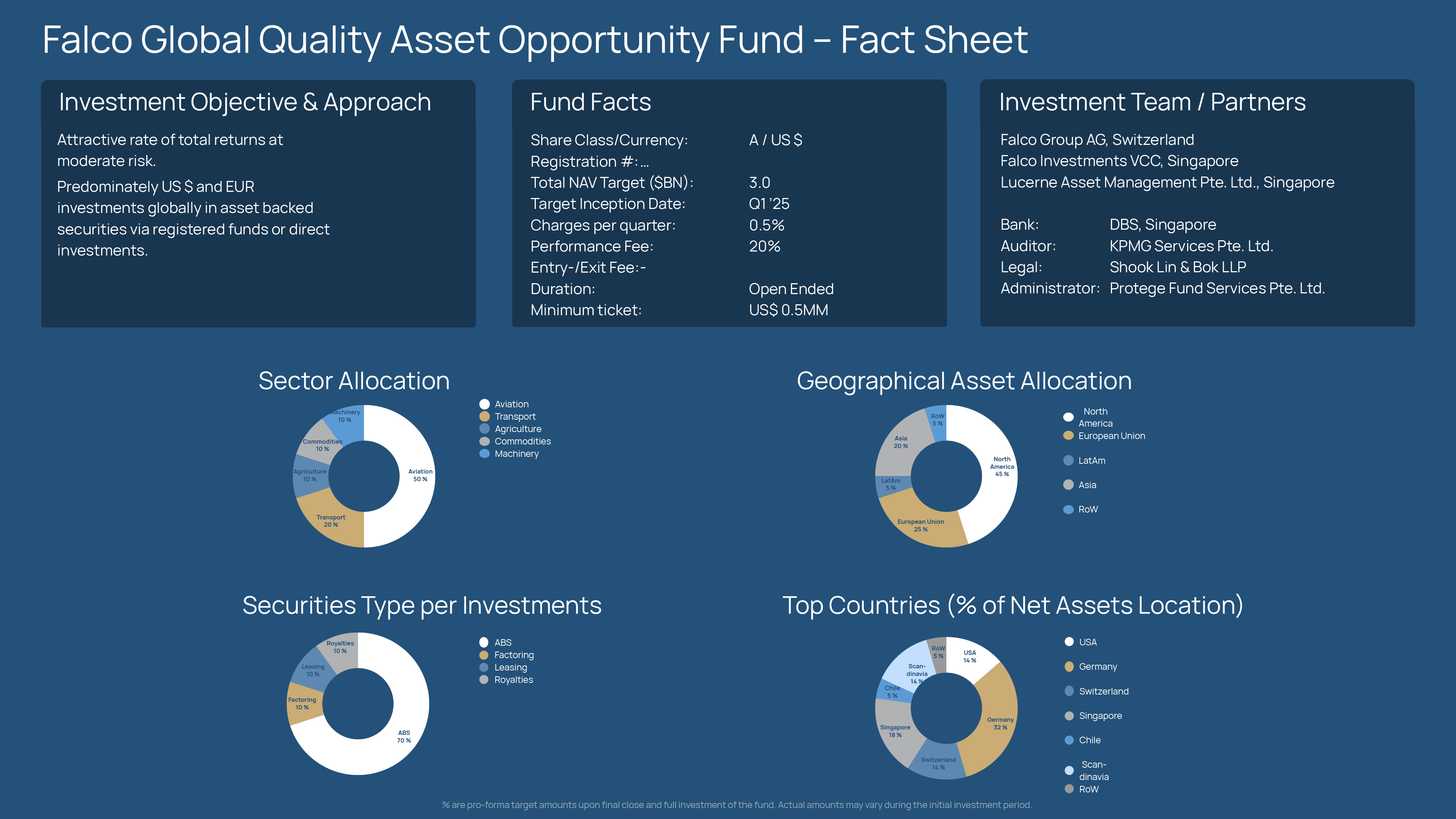

The Falco Global Quality Asset Opportunity Fund invests in asset-backed securities (ABS), excluding real estate and traditional debt, focusing on revenue-generating assets such as infrastructure receivables, intellectual property royalties, and equipment leases to optimize risk-adjusted yields through structured finance and diversification.

The Falco Global Quality Asset Opportunity Fund is registered under Falco Investment VCC in the Replublic of Singapore with registration number: T24VC0035H-SF003

Prior to founding “The Protection Fund”, we were active as PE advisors in value creation and operational improvement. We have also supported and worked with organizations as advisors and/or angel investors:

Bettermarks is a SaaS Educational Technology company, based in Berlin, Germany. It provides an adaptable tutoring platform for classes 5–12 which provides smart learning algorithms to support students and teachers in subjects like math and science. Founded in 2008 it has gained traction in a number of countries around the globe and is available in multiple languages.

CCI invests in food, water, and energy sectors with a focus on innovation and sustainability. Through its flagship CCI Climate Opportunities Fund, it takes an engaged, multi-stage approach, supporting companies at a commercial inflection point and adding value through active involvement and long-term, patient investment strategies.

Fountain is the only workforce management platform designed for hiring, managing, and retaining frontline workers, who are essential employees involved in primary business operations like retail, healthcare, hospitality, and logistics. Powered by AI and automation, Fountain's multi-product solution integrates with existing HR technology stacks to streamline the applicant experience and save HR teams time and resources.

Founded in 2004, Virium Investimenti SA offers all-round service in order to meet its clients’ financial goals through the creation and the analysis of investment portfolios, customized investment solutions and family office services. Its dynamic team, made up of experienced specialists, is ready to promote innovative structures and technologies with the sole purpose of strengthening the assets of the individual client.

ESG standards are part of Falco Global Partners’ corporate DNA. People first!

Disclosure and transparency, and mutual benefits are our guiding principles when dealing with anybody.

Ethics, transparency, and care are the pillars of our own business and our portfolio companies. The ultimate objective is to make a positive contribution to environmental, social, and governance (ESG) principles.

Local and global businesses must remain sensitive and loyal to inclusiveness regarding different cultural values, with full compliance with international and local laws and regulations.

Falco Global Partners actively supports expanding the reach and impact of its partner organizations. By combining our international network and resources with their grassroots expertise, we help ensure that compassion and social responsibility are translated into meaningful, lasting change. These collaborations are part of Falco Global Partners’ broader commitment to working with leading NGOs worldwide, empowering initiatives that drive sustainable impact and improve lives for generations to come.

Please get in touch with any enquiries through one of the following channels:

Rotfluhstrasse 83

8702 Zollikon

Switzerland